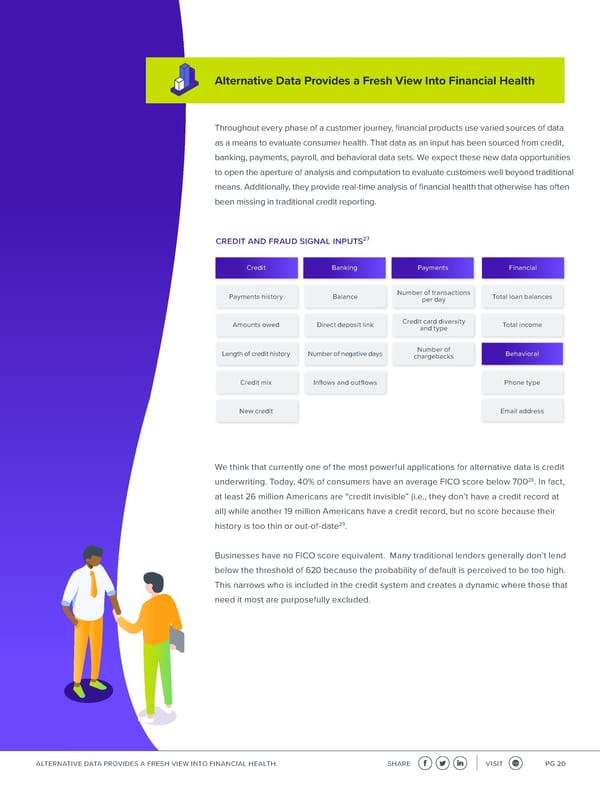

Alternative Data Provides a Fresh View Into Financial Health Throughout every phase of a customer journey, 昀椀nancial products use varied sources of data as a means to evaluate consumer health. That data as an input has been sourced from credit, banking, payments, payroll, and behavioral data sets. We expect these new data opportunities to open the aperture of analysis and computation to evaluate customers well beyond traditional means. Additionally, they provide real-time analysis of 昀椀nancial health that otherwise has often been missing in traditional credit reporting. credit and fraud signal inputs27 Credit Banking Payments Financial Payments history Balance Number of transactions Total loan balances per day Amounts owed Direct deposit link Credit card diversity Total income and type Length of credit history Number of negative days Number of Behavioral chargebacks Credit mix In昀氀ows and out昀氀ows Phone type New credit Email address We think that currently one of the most powerful applications for alternative data is credit 28. In fact, underwriting. Today, 40% of consumers have an average FICO score below 700 at least 26 million Americans are “credit invisible” (i.e., they don’t have a credit record at all) while another 19 million Americans have a credit record, but no score because their 29 history is too thin or out-of-date . Businesses have no FICO score equivalent. Many traditional lenders generally don’t lend below the threshold of 620 because the probability of default is perceived to be too high. This narrows who is included in the credit system and creates a dynamic where those that need it most are purposefully excluded. ALTERNATIVE DATA PROVIDES A FRESH VIEW INTO FINANCIAL HEALTH SHARE VISIT PG 20

Immersive Experience | Fintech Revolution Page 19 Page 21

Immersive Experience | Fintech Revolution Page 19 Page 21