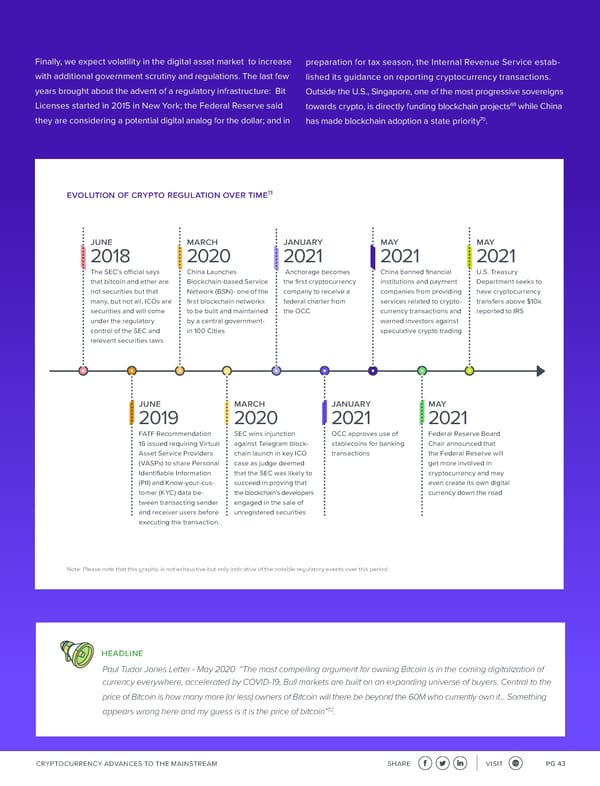

Finally, we expect volatility in the digital asset market to increase preparation for tax season, the Internal Revenue Service estab- with additional government scrutiny and regulations. The last few lished its guidance on reporting cryptocurrency transactions. years brought about the advent of a regulatory infrastructure: Bit Outside the U.S., Singapore, one of the most progressive sovereigns Licenses started in 2015 in New York; the Federal Reserve said 69 towards crypto, is directly funding blockchain projects while China they are considering a potential digital analog for the dollar; and in 70. has made blockchain adoption a state priority . 71 evolution of crypto regulation over time june march january may may 2018 2020 2021 2021 2021 The SEC’s o昀케cial says China Launches Anchorage becomes China banned 昀椀nancial U.S. Treasury that bitcoin and ether are Blockchain-based Service the 昀椀rst cryptocurrency institutions and payment Department seeks to not securities but that Network (BSN)- one of the company to receive a companies from providing have cryptocurrency many, but not all, ICOs are 昀椀rst blockchain networks federal charter from services related to crypto- transfers above $10k securities and will come to be built and maintained the OCC currency transactions and reported to IRS under the regulatory by a central government- warned investors against control of the SEC and in 100 Cities speculative crypto trading relevant securities laws june march january may 2019 2020 2021 2021 FATF Recommendation SEC wins injunction OCC approves use of Federal Reserve Board 16 issued requiring Virtual against Telegram block- stablecoins for banking Chair announced that Asset Service Providers chain launch in key ICO transactions the Federal Reserve will (VASPs) to share Personal case as judge deemed get more involved in Identi昀椀able Information that the SEC was likely to cryptocurrency and may (PII) and Know-your-cus- succeed in proving that even create its own digital tomer (KYC) data be- the blockchain’s developers currency down the road tween transacting sender engaged in the sale of and receiver users before unregistered securities executing the transaction. Note: Please note that this graphic is not exhaustive but only indicative of the notable regulatory events over this period headline Paul Tudor Jones Letter - May 2020 “The most compelling argument for owning Bitcoin is in the coming digitalization of currency everywhere, accelerated by COVID-19, Bull markets are built on an expanding universe of buyers. Central to the price of Bitcoin is how many more (or less) owners of Bitcoin will there be beyond the 60M who currently own it... Something 72 appears wrong here and my guess is it is the price of bitcoin” . CRYPTOCURRENCY ADVANCES TO THE MAINSTREAM SHARE VISIT PG 43

Immersive Experience | Fintech Revolution Page 42 Page 44

Immersive Experience | Fintech Revolution Page 42 Page 44