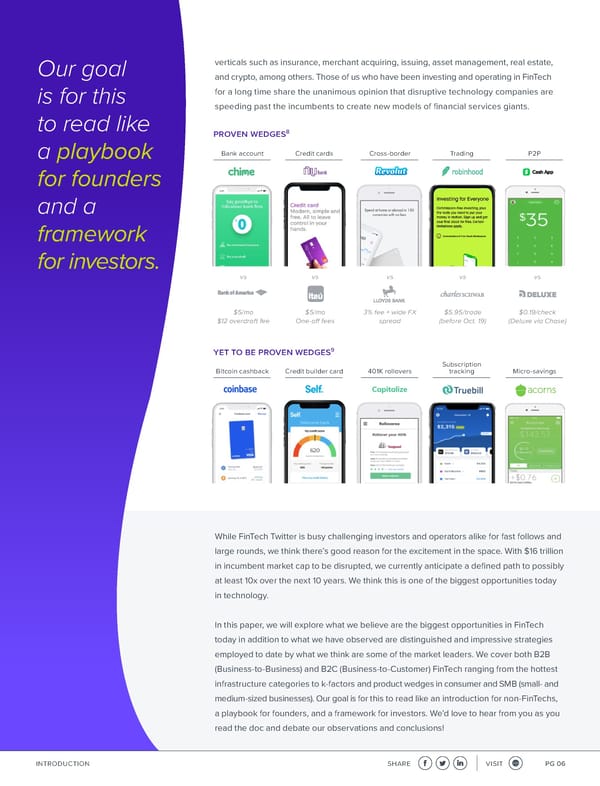

Our goal verticals such as insurance, merchant acquiring, issuing, asset management, real estate, and crypto, among others. Those of us who have been investing and operating in FinTech is for this for a long time share the unanimous opinion that disruptive technology companies are to read like speeding past the incumbents to create new models of 昀椀nancial services giants. proven wedges8 a playbook Bank account Credit cards Cross-border Trading P2P for founders and a framework for investors. vs vs vs vs vs $5/mo $5/mo 3% fee + wide FX $5.95/trade $0.19/check $12 overdraft fee One-o昀昀 fees spread (before Oct. 19) (Deluxe via Chase) yet to be proven wedges9 Subscription Bitcoin cashback Credit builder card 401K rollovers tracking Micro-savings While FinTech Twitter is busy challenging investors and operators alike for fast follows and large rounds, we think there’s good reason for the excitement in the space. With $16 trillion in incumbent market cap to be disrupted, we currently anticipate a de昀椀ned path to possibly at least 10x over the next 10 years. We think this is one of the biggest opportunities today in technology. In this paper, we will explore what we believe are the biggest opportunities in FinTech today in addition to what we have observed are distinguished and impressive strategies employed to date by what we think are some of the market leaders. We cover both B2B (Business-to-Business) and B2C (Business-to-Customer) FinTech ranging from the hottest infrastructure categories to k-factors and product wedges in consumer and SMB (small- and medium-sized businesses). Our goal is for this to read like an introduction for non-FinTechs, a playbook for founders, and a framework for investors. We’d love to hear from you as you read the doc and debate our observations and conclusions! INTRODUCTION SHARE VISIT PG 06

Immersive Experience | Fintech Revolution Page 5 Page 7

Immersive Experience | Fintech Revolution Page 5 Page 7